In early April 2025, eight OPEC+ members (Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, Oman) met virtually and reaffirmed their commitment to market stability, citing healthy supply–demand fundamentalsopec.org.

They noted strong global oil demand and a steady economic outlook as the basis for a cautious supply increaseopec.orgimf.org. This builds on prior voluntary cuts announced in April and November 2023 and aligns with earlier decisions (Dec 2024, reaffirmed Mar 2025) to gradually unwind those cuts

OPEC+ leaders emphasized that oil market fundamentals remain robust: demand is strong and inventories have been well-managedopec.orgiea.org. For example, OECD inventories are near historic lows, supporting the positive assessment.

The IMF reports the global economy has largely stabilized with modest growthimf.org. This “steady but underwhelming” expansion means oil consumption is supported, though trade tensions and geopolitical risks could slow future demandimf.orgiea.org.

Analysts note current data (e.g. solid first-quarter 2025 oil consumption) suggest demand is holding upiea.org. OPEC+’s reference to a “positive market outlook” reflects confidence that the global economy can sustain oil demand despite headwinds.

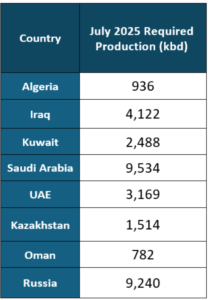

The group agreed to implement a production adjustment of +411,000 barrels per day in May 2025opec.org. This is equivalent to three monthly increments rolled into one, far above the originally planned 135,000 bpd increasereuters.com. In effect, OPEC+ is accelerating its supply increase while monitoring the market.

This adjustment covers the May increment plus two extra monthly hikesreuters.com. The statement explicitly allows these increases to be “paused or reversed subject to evolving market conditions,” providing flexibilityopec.orgreuters.com.

The accelerated output will also help members compensate for any overproduction since early 2024opec.org. In practice, the participating countries can “accelerate their compensation” for past quota overruns due to this single stepped increase.

OPEC+ will meet monthly to review conditions; the next meeting on May 5, 2025 will set June production levelsopec.orgreuters.com. This rolling schedule ensures ongoing alignment of supply with market needs.

The +411,000 bpd boost in May combines one planned increment with two additional increments, effectively speeding up the phase-out of the previous 2.2 million bpd voluntary cutreuters.com.

OPEC+ underscored that the output increases are flexible: they “may be paused or reversed” if the oil market weakensopec.orgreuters.com. This mechanism allows the alliance to step in to stabilize the market if necessary.

The announcement led to an immediate drop in oil prices. Brent crude fell over 6% on the dayreuters.com, reflecting market concern over the extra supply.

OPEC+ justified the hike by pointing to healthy fundamentalsreuters.com, but the surprise size of the increase put downward pressure on energy markets. Traders noted that advancing three months of supply into one release more oil than expected, which initially sent prices lower.

Analysts say this move demonstrates OPEC+’s pricing power. By advancing the output plan, the group both supports prices (by avoiding under-supply) and forces full compliance from all membersreuters.comrigzone.com. For example, high production by Kazakhstan had been curbing OPEC+ targets, and this plan helps incentivize cuts to rebalance the marketreuters.comrigzone.com.

In summary, energy market observers view the action as a balancing act: OPEC+ is cautiously boosting supply to match demand while remaining ready to curb output if prices slip too farrigzone.comiea.org. This reflects the alliance’s goal of preventing sharp price swings.

The higher production signals confidence that near-term oil demand will remain solid. The IEA reported robust oil use in early 2025 despite trade conflictsiea.org, supporting OPEC+’s decision to increase supply.

Nevertheless, there are warning signs: economic growth forecasts have been revised down due to tariffs and uncertaintyimf.orgiea.org. Slower growth could dampen future crude demand, meaning OPEC+ may need to adapt again.

By aligning production with demand, OPEC+ is aiming to stabilize the global oil market. Industry experts stress that disciplined supply management is “increasingly critical to the stability of the oil market”rigzone.com. In other words, the alliance’s flexibility helps smooth out imbalances in the broader energy market.

The coming months will test this strategy. OPEC+ will adjust supply in response to evolving conditions, keeping global energy markets balanced. The alliance’s proactive stance – raising output now but monitoring conditions – is intended to support a steady global economy and avoid sudden price shocks in the crude oil sectoropec.orgrigzone.com.