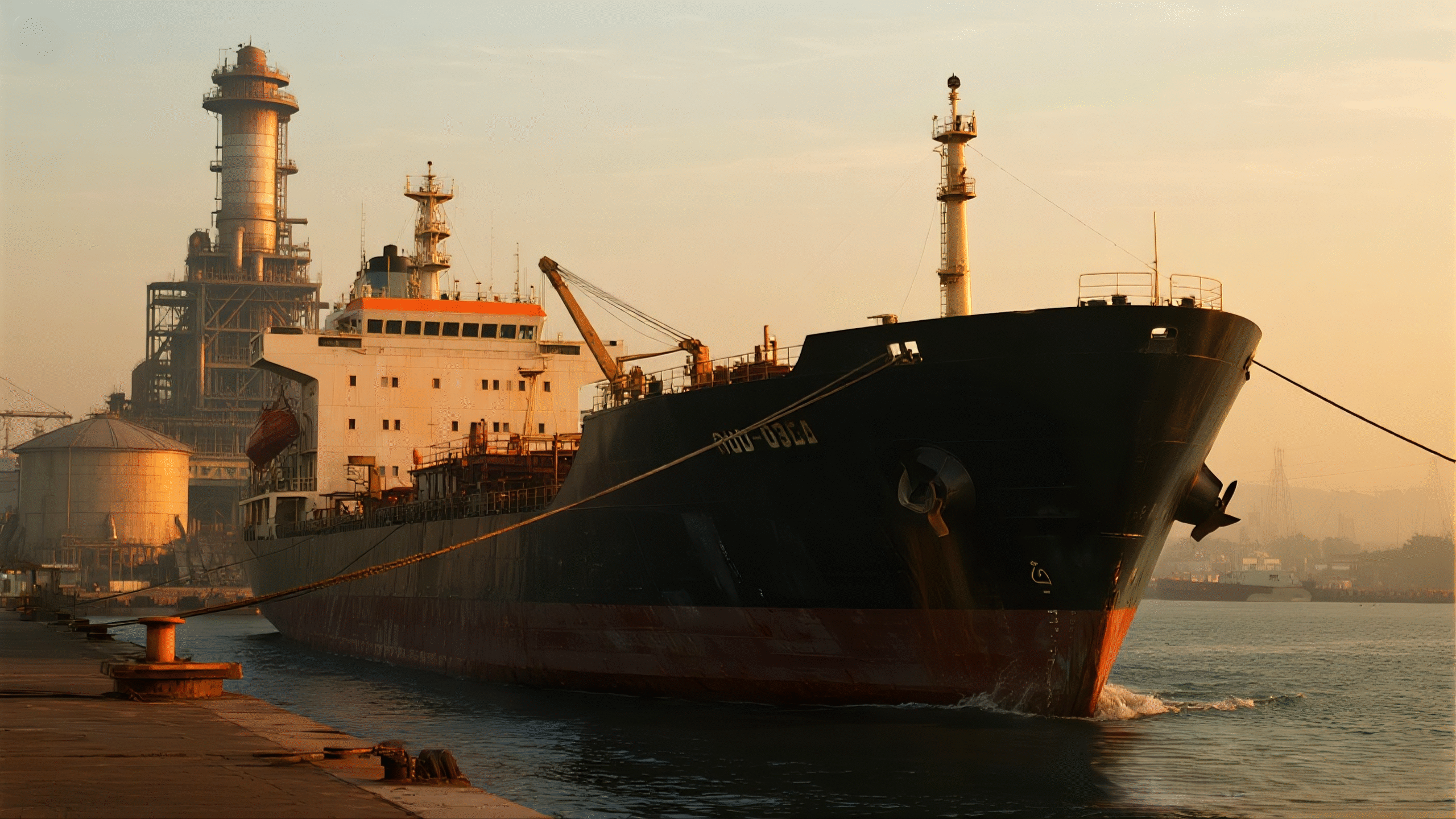

Saudi Aramco and Iraq’s state marketer SOMO have stopped selling crude to India’s Nayara Energy after the European Union included the refinery in its July sanctions package tied to Russian energy links. The stoppage forced Nayara to rely largely on Russian barrels in August, cut runs at its 400,000 bpd Vadinar refinery and lean on non-standard shipping arrangements while it scrambles for alternatives.

Although the halt affects shipments to a single private refiner, the story matters because Nayara:

Runs one of India’s largest complex refineries (Vadinar, ~400,000 barrels per day),

Accounts for ~8% of India’s refining capacity and significant refined product exports, and

Has substantial Russian ownership (Rosneft ~49% stake), which is the reason it was targeted by the EU sanctions.

That mix of scale, export orientation and ownership makes the supply disruption both a regional energy-market and geopolitical story.

Nayara Energy (formerly Essar Oil) operates the Vadinar refinery in Gujarat and a large retail network in India. Rosneft and related Russian entities own around a 49% stake in the company, which has made the refinery a target for recent EU measures aimed at limiting Russia’s energy revenues. The EU’s 18th sanctions package (adopted July 18, 2025) specifically included measures on Russian-linked energy flows and listed the refinery among entities affected, while also lowering the crude price cap and tightening rules around the “shadow fleet.”

Key operational points reported by shipping/market data and industry sources:

Vadinar refinery capacity: ~400,000 barrels per day.

Nayara typically received roughly 2 million barrels/month of Iraqi crude and ~1 million barrels/month of Saudi crude, but those Gulf deliveries stopped in August.

The company cut crude runs to about 70–80% of capacity and has faced trouble selling and shipping products after sanctions.

Three practical drivers explain why Saudi Aramco and Iraq’s SOMO paused shipments:

Compliance & payment risk: EU measures and tightened rules around payments and transactions can disrupt normal letters of credit, correspondent banking or other payment rails. Sources say sanctions created payment complications for purchases from SOMO. In that environment suppliers and trading desks often pause new business until compliance paths are certain.

Reputational and regulatory risk: State oil firms and national champions weigh the legal and diplomatic fallout of selling to an entity recently listed in a major sanctions package. That caution is especially true when insurers, banks and charterers also withdraw.

Logistics & shipping friction: Shippers and insurers pulled back from moving products linked to a sanctioned entity, forcing Nayara to use vessels in the so-called “dark fleet” and rely more heavily on Russian direct supply channels arrangements that increase cost, complexity and scrutiny.

These drivers are not unique to Nayara; they mirror how sanctions ripple through finance, insurance, shipping and trade execution, often faster than physical production can adjust.

Short-to-medium term impacts:

Refinery throughput & exports: With Vadinar operating at reduced runs (70–80%), product availability for both exports and domestic supply is constrained; Nayara had been an important exporter of jet fuel and gasoline to Europe and other regions. That export channel is now constrained, forcing re-routing or domestic absorption of volumes.

India’s import mix may shift further toward Russia: India already increased purchases of discounted Russian crude in FY 2024–25 (Russia accounted for a large share of imports). The suspension by major Gulf sellers to a single refinery will likely accelerate reliance by that refinery and possibly others on Russian barrels, at least until freight/finance issues are resolved.

Diplomatic friction: New Delhi has made clear it does not endorse unilateral measures that undermine its energy security. The sanctions and secondary effects create diplomatic balancing acts between India, EU capitals and Gulf suppliers; New Delhi may press for carve-outs, pragmatic workarounds or state support to secure supplies for domestic markets.

Economic knock-on effects: For Nayara, lower runs mean lower refined product sales and margins, potential cash-flow stress, and management changes (the CEO resigned in July and a new CEO appointment followed). For customers and downstream distributors, there may be short-lived logistical headaches and pricing noise.

A few points to keep in mind when assessing market impact:

Local vs global scale: The stoppage affects shipments to one large private refiner (Vadinar ~400 kbpd). While material, it is unlikely alone to create a long-lasting global crude supply shock because alternative crude flows exist and many buyers can re-route purchases. Markets have shown limited dramatic price responses so far.

Refined product dislocations: The most likely immediate effect is regional dislocation in refined product markets (jet fuel and gasoline), shipping and insurance costs rising for cargoes linked to the sanctioned chain, and increased volatility in specific arbitrage routes (Europe → Asia, SE Asia → Africa).

Policy levers matter: The EU’s lowered price cap on Russian crude and the expanded shadow-fleet blacklists increase enforcement pressure; tighter enforcement would raise transaction costs for buyers working around the cap and could push prices modestly higher for certain grades while keeping headline Brent relatively contained.

Bottom line: expect localized supply frictions and higher logistics/insurance costs for sanctioned flows, but not a major global Brent shock unless sanctions scale up or additional, larger suppliers are pulled into similar actions.

The recent EU sanctions against Rosneft… are set to create significant challenges for Nayara as it is likely to have a pronounced impact on its jet fuel and kerosene sales, which were primarily being exported to Europe.” — Abhishek Ranjan, S&P Global Commodity Insights.

“There is a six-month transition period. A lot could change by then.” — Senior Indian refining source (industry observation on the EU’s transition window). The EU’s package includes transitional measures that give operators time to adapt.

Reuters reporting also highlights that payment complications and shippers pulling back were central operational reasons Gulf sellers paused deliveries.

Rosneft pushed back against the sanctions, calling them “far-fetched” in a public statement, emphasizing Nayara is an Indian legal entity — a reminder that corporate ownership structures and national legal frameworks will be central in any resolution.