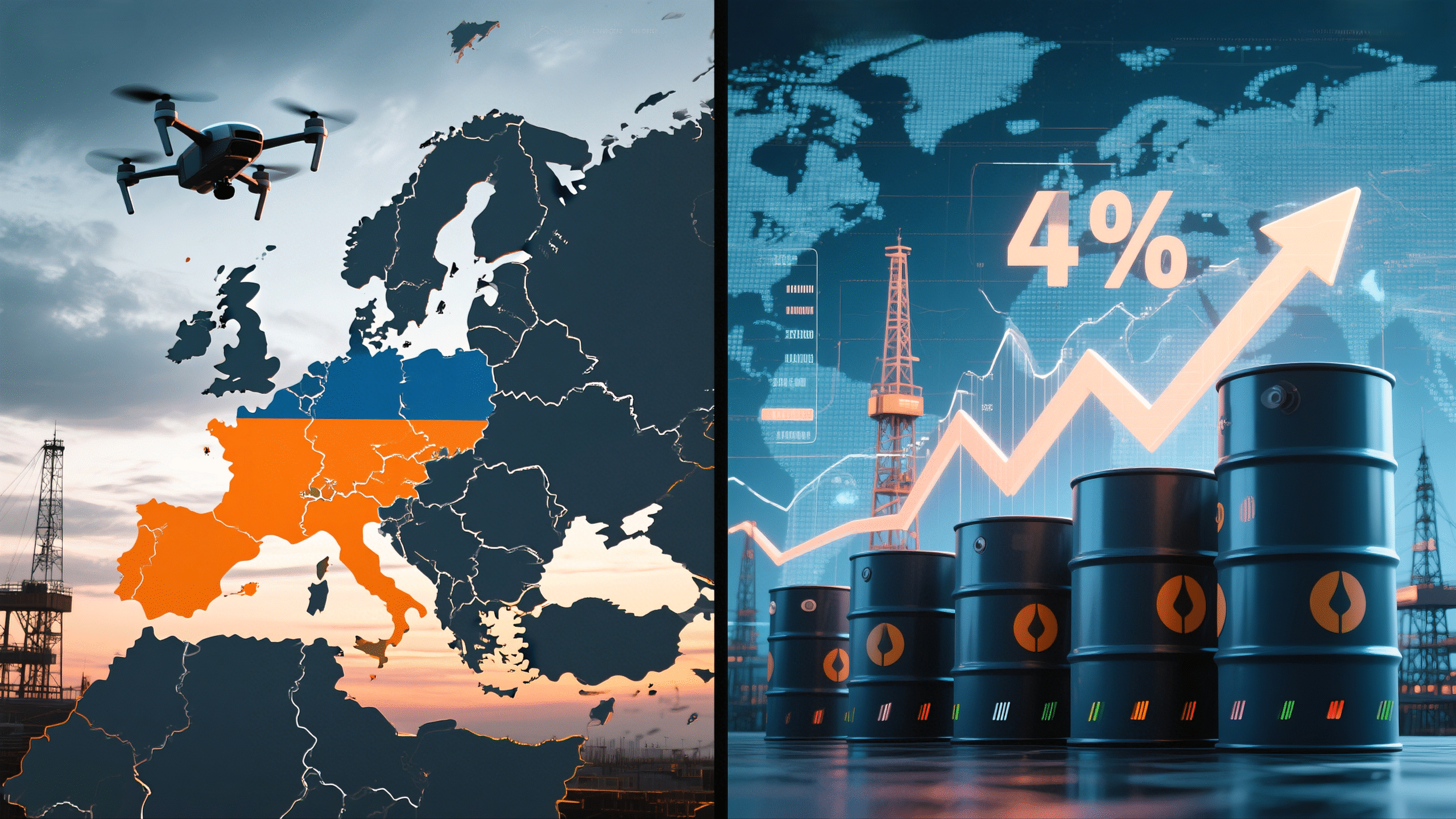

Oil prices surged on Monday, driven by rising geopolitical tensions and supply concerns. In New York midday trading, Brent crude climbed to about $65.15 per barrel and U.S. West Texas Intermediate (WTI) hit roughly $63.17 — gains of nearly 4% on the dayoilandgas360.com. This sharp jump came after Ukraine launched a major drone assault on four Russian military airbases overnight. The attacks reportedly destroyed some 40 Russian aircraft and sparked fires in surrounding areas, escalating the Ukraine conflictoilandgas360.com. The unexpected strike deep inside Russian territory sharply increased market unease, sending crude oil prices higher as traders priced in potential supply disruptionsoilandgas360.com.

These headlines underscore a key trend: oil traders remain on edge. Even as the OPEC+ alliance agreed to modest production hikes, rising geopolitical risk drove oil prices up. This blog post explains the forces behind the recent price spike, with original commentary and insights into what it means for global energy markets.

Global oil markets experienced a significant uptick as Brent crude prices surged by 4%, reaching over $65 per barrel. This increase comes despite OPEC+’s announcement to raise production by 411,000 barrels per day. The primary catalyst for this price surge is the escalating geopolitical tension following Ukraine’s drone attacks on Russian military airfields.

On June 2, energy markets reacted strongly to news of Ukraine’s large-scale drone strikes on Russia’s Kursk and Voronezh regions. According to analysts, Ukraine’s overnight attacks on Russian air bases led to fires in residential areas and road disruptions, while more than 40 military aircraft were reportedly destroyedoilandgas360.com. Russian defense officials said they intercepted 162 drones, illustrating the scale of the assaultoilandgas360.com. This escalation in the Ukraine conflict injected fresh geopolitical risk into oil markets, as traders worry about possible countermeasures or supply cutoffs.

The immediate market response was evident by Monday afternoon: Brent crude futures jumped to around $65.15 per barrel, up about 3.8%, and WTI futures rose to roughly $63.17, up about 3.9%oilandgas360.com. In short, oil prices jumped roughly 4% on the day. OilPrice.com notes that this surge was “attributable to escalating geopolitical tensions” after the drone strikeoilandgas360.com. In plain terms, traders viewed the Russia-Ukraine clash as a risk to global oil flows, lifting crude oil prices in a hurry.

Key point: The Ukraine conflict remains a wildcard for energy markets. This week’s events show how a single military action can provoke a market ripple, even as OPEC+ decision-makers move to increase supply.

At first glance, markets had expected a neutral or downward effect from OPEC+ policies. In late May, the OPEC+ coalition (which includes major producers like Saudi Arabia and Russia) announced a standard 411,000 barrels-per-day output increase for July — the same pace of expansion that applied in May and Juneoilandgas360.com. This move had been widely anticipated, so it was largely “priced in” to contracts in advance. In other words, OPEC+ was being cautious and gradual about ramping up supply to meet demandoilandgas360.com.

Yet this OPEC+ boost could not cancel out the sudden surge in prices caused by the Ukraine-related scare. As OilPrice.com observes, the market reacted not only to OPEC+’s production plans but also to the “dual impact of geopolitical instability and OPEC+’s cautious approach to increasing supply”oilandgas360.com. In practice, this means that even though more oil was coming to the market under the OPEC+ deal, traders felt that the geopolitical risk from the Ukraine conflict loomed larger in the short term, outweighing the incremental supply increase.

Adding context, financial firms have been weighing in on supply outlook. Goldman Sachs analysts told clients they expect the next (and likely final) OPEC+ supply hike — another 411,000 bpd — to come in Augustoilandgas360.com. Goldman noted that while global oil demand may slow somewhat, the drop won’t be large enough to halt production increases by mid-Julyoilandgas360.com. In other words, the consensus view is that demand growth remains solid enough into summer that OPEC+ will keep modestly increasing output, even as they note a tentative demand outlook.

Meanwhile, Morgan Stanley added that it anticipates three more monthly OPEC+ output increases beyond July. These would cumulatively add about 2.2 million barrels per day to global supply (not counting any extra output from countries exceeding their quotas)oilandgas360.com. In theory, this gradual ramp-up should help meet demand and stabilize oil prices over time. But for now, the immediate cause of Monday’s rally was geopolitical – proving once again how sensitive oil prices are to unexpected global events.

Original insight: OPEC+ oil supply policy often serves as a backdrop to price movements, but truly unexpected events — like surprise drone strikes — can override even coordinated production plans. Today’s 4% jump suggests traders think that geopolitical factors can dominate OPEC+ signals in the short run, at least until tensions subside.

Market analysts have had plenty to say about the current situation. ING Group, a global financial institution, pointed out that oil markets are reacting to a “dual impact” – namely, the heightened geopolitical instability from Ukraine and OPEC+’s cautious stance on supplyoilandgas360.com. In other words, uncertainty about the Ukraine war is on one side, and on the other side is the fact that OPEC+ is only easing output slowly. These combined pressures “are driving prices higher,” ING analysts wroteoilandgas360.com.

ING also noted that political dynamics could change things down the road. For example, U.S. President Trump (still influential in Republican circles) has been frustrated with Russia but has so far held off imposing extra sanctions on Russian oil. ING suggests that if Washington or its allies were to target Russian oil exports more aggressively, it could “change the outlook for the oil market drastically”oilandgas360.com. That hypothetical scenario – another surge of political risk – would almost certainly send oil prices even higher.

Other analyst views align on the theme of supply-demand balance. Many traders had already believed markets were tight before Monday’s news: oil inventories have been drawn down, and disruptions in countries like Iran and Venezuela continue to tighten supply. Against that backdrop, any shock – such as the drone strikes – pulls prices up.

Adding to the market’s complexity, U.S. lawmakers are advocating for stricter sanctions on Russian oil exports. Senators Lindsey Graham and Richard Blumenthal have proposed measures targeting countries importing Russian oil, including potential tariffs. Such actions could further constrain global oil supplies, exerting additional upward pressure on prices.

Here’s a quick summary of market perspectives on the oil-price jump:

Geopolitical risk dominates. The Ukraine conflict, especially unanticipated events like the drone attack, casts a long shadow over supply expectations. This can overshadow regular OPEC+ supply adjustmentsoilandgas360.comoilandgas360.com.

Steady demand growth. Despite talk of a “demand slowdown,” most forecasters still see healthy oil consumption in 2025. That’s why OPEC+ has been boosting output – to keep up with continuing demandoilandgas360.com.

Cautious OPEC+. The producers’ group isn’t flooding the market; its cautious increases (411,000 bpd per month) reflect a balancing act. Traders see this as relatively modest, not enough to quickly ease tight markets.

Influence of sanctions. Much depends on future sanctions or policy moves. So far, countries like the U.S. have hesitated to curtail all Russian exports. If that changes, oil prices could react dramaticallyoilandgas360.com.

Market volatility returning. After a period of relative calm, oil prices are more volatile again. Short-term spikes (and dips) could become common as traders digest news from Ukraine, OPEC, and other global events.

By understanding these perspectives, readers can see that oil prices today are being shaped by a complex interplay of supply policies and international conflict. No single factor fully explains Monday’s move; rather, it’s the combination of continued OPEC+ output discipline and a sudden flare-up in geopolitical riskoilandgas360.comoilandgas360.com.

Near 4% jump in oil prices: On June 2, Brent and WTI crude prices leaped about 4% as markets absorbed news of Ukraine’s drone strikesoilandgas360.com.

Ukraine conflict impact: The drone attacks on Russian airbases (Kursk and Voronezh regions) destroyed dozens of aircraft and raised fears of supply disruptionsoilandgas360.com.

OPEC+ production plan: OPEC+ plans continued output hikes (another 411,000 bpd in July), a move already expected by tradersoilandgas360.com. This modest increase did not prevent the price rally.

Analyst view – dual pressure: Experts note oil markets are under “dual impact” of geopolitical risk and cautious OPEC+ supply growthoilandgas360.com. Both are pushing prices higher.

Demand outlook remains solid: Despite talk of slowing demand, firms like Goldman Sachs and Morgan Stanley see demand remaining strong enough to warrant continued OPEC+ increasesoilandgas360.comoilandgas360.com.

Global energy market implications: Rising prices imply tighter supply-demand balance. If tensions persist or intensify, expect further volatility in the global energy markets.

The energy market fallout from this price jump could spread in several ways:

Fuel and inflation: Higher oil prices feed into higher gasoline and diesel costs. Consumers might see pump prices inch up, which can contribute to broader inflationary pressure in economies. Governments and central banks will be watching this.

Refining and supply chains: If oil remains expensive, refiners may adjust operations. Already, some regions face refinery disruptions (maintenance or capacity limits) which strain product supply. Sustained higher crude prices could widen refining margins, but also prompt efforts to boost refinery output where possible.

Investment signals: For oil producers, higher prices are a green light to invest more. Companies might accelerate drilling or exploration plans. But for oil importers, there’s motivation to conserve energy or diversify sources.

Geopolitical shifts: The price jump highlights how geopolitics shape energy security. Countries heavily reliant on imported oil (or on Russian oil) will be especially attentive. Alternate supplies (like from U.S. shale, Middle East, etc.) could become more valuable.

Longer-term demand: In Asia and emerging markets, robust energy demand is expected to continue. This demand outlook supports prices. However, any sustained conflict that affects supplies (e.g., hitting pipelines or ports) could complicate forecasts.

Policy response: Some governments may react. For example, nations could release strategic reserves to tame price spikes. Or, as ING pointed out, they might consider new sanctions affecting oil flows, which in turn could further tighten markets.

Featured snippet readiness: Here’s a concise answer to a likely question: Why did oil prices jump 4% on June 2, 2025? Answer: Oil surged due to Ukraine’s overnight drone strikes on Russian airbases, which heightened geopolitical risks, even as OPEC+ had announced modest production increases. Traders interpreted the conflict news as a threat to oil supply, pushing prices upoilandgas360.comoilandgas360.com.

Overall, the scenario underscores a critical lesson: oil prices today are highly sensitive to geopolitical shocks. Even expected supply hikes by major producers (OPEC+) can be overshadowed by sudden events in conflict zones. For general readers and energy market watchers, the takeaway is that both demand conditions and geopolitical stability shape the oil price outlook.

The confluence of geopolitical tensions and OPEC+’s restrained production increase has led to heightened market volatility. Investors are closely monitoring the situation, with energy stocks experiencing modest gains. Companies like Chevron and Exxon Mobil saw stock increases of 0.7% and 0.8%, respectively, reflecting investor confidence in the energy sector amidst rising oil prices.

The 4% jump in oil prices on Monday highlights how the combination of geopolitical risk and supply decisions can move markets. With Ukraine’s conflict still unresolved and OPEC+ taking a steady approach to production increases, volatility in crude oil prices is likely to persist. Energy analysts will be watching upcoming OPEC+ meetings, global demand data, and any further escalations in the Ukraine war for clues on future price trends.

Stay informed: For further updates on crude oil and energy markets, keep an eye on leading energy news outlets. If you found this analysis helpful, please share it or subscribe for more insights.

Source: Content adapted and updated from OilPrice.com reportingoilandgas360.comoilandgas360.com.

The recent surge in oil prices underscores the delicate balance between geopolitical events and energy market dynamics. As tensions between Ukraine and Russia escalate and OPEC+ maintains a cautious production strategy, markets are poised for continued volatility. Stakeholders must remain vigilant, adapting strategies to navigate the evolving energy landscape.